owe state taxes but not federal

Unlike federal taxes the state ones are determined by your states government. Pay any balance that you owe by the filing.

5 Common Reasons Why You Might Owe Taxes This Year Gobankingrates

Lets say you have a single 48-year-old taxpayer in Philadelphia Pennsylvania with a taxable income of 65000.

. When you file your federal income tax return you can check the status of your tax refundby visiting the IRS website or its mobile app. You will enter your income deductions and credits. There are also states that apply no income tax but they still have ways to collect money.

The tax bracket you land in at the state level can differ from your federal tax bracket which is one reason you might owe state taxes but not federal. Will not levy income tax. Im not going to lie though its probably.

We will send you a Form W-4P-A Election of Federal Income Tax Withholding and instructions for making the change. Complete your federal tax return but not file it. Too little withheld from their pay.

There are 43 states. Federal Income Tax Example. Reason 1 The employee didnt make enough money for income taxes to be withheld.

If you need more time to file your state taxes the best option is usually to. Why Do I Owe. California also ranks fourth for combined income and sales tax rates at 11 with only New York New Jersey.

Taxes are not the same in each state they are calculated differently. Will levy income tax. Here are the five most common reasons why people owe taxes.

The IRS and other states had made sweeping changes to employee withholding. However each state has its own process. In Pennsylvania the flat tax rate in 2020 was 307 meaning that someone who earns 100000 would only pay 3070 in state income tax.

A spokesperson for DFA said he expects an answer to come this week. State Income Tax vs. You will also report how much of your state tax.

Federal and State tax laws differ so the calculations that are used on the federal level are different than the state. The state announced on Aug. What that means is that you cant expect to get the same benefits that someone who works in the federal government gets because they are in the federal system.

June 6 2019 124 AM. You can give yourself a raise just by changing your Form W-4 with your. There are only 8 states that have a.

The change in your withholdings will be made after we receive your. Why do I owe state taxes but not federal. The tax bracket you land in at the state level can differ from your federal tax bracket which is one reason you might owe state taxes but not federal.

Some states have better taxes compared to others. The best way to figure out if you owe taxes is to complete your tax forms completely. 29 that residents who receive loan forgiveness will not owe state.

The tax bracket you land in at the state level can differ from your federal tax bracket which is one reason you might owe state taxes but not federal. It has the highest state income tax rate in the country at 133. In years past we would get a very small refund from NJ but would owe at least a couple hundred in Delaware.

Last year we paid 1200 to Delaware. Will not levy income tax. 1 Best answer.

Understanding Your Tax Forms The W 2

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

Can I Get A Mortgage If I Owe Federal Tax Debt To The Irs

What To Do If You Owe The Irs Back Taxes H R Block

Why Do I Owe State Taxes Smartasset

Why Do I Owe State Taxes This Year Why So Much 2022 Guide

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Paycheck Taxes Federal State Local Withholding H R Block

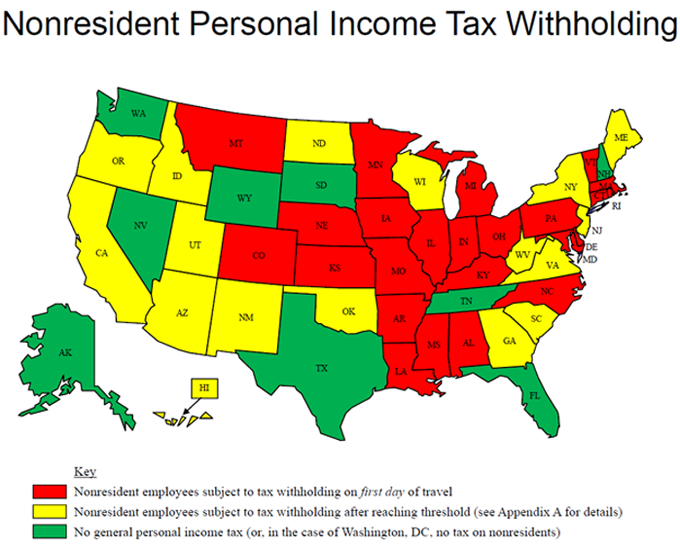

I Live In One State Work In Another Where Do I Pay Taxes Picnic Tax

Form W 4 Tax Withholding For Irs And State Income Taxes

Penalties For Filing Your Tax Return Late Kiplinger

How To Fill Out The Irs Non Filer Form Get It Back

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Consequences Of Not Filing Or Paying State Taxes Tax Group Center

Road Warrior State Income Tax Laws Vary Widely The Pew Charitable Trusts

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

:max_bytes(150000):strip_icc()/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)

Tax Refund Missing Reasons You Never Received One

Publication 17 2021 Your Federal Income Tax Internal Revenue Service